A Primer on Stock Splits

Hello friends. A warm welcome to new readers and subscribers. I am glad you are here! This week saw quite a proliferated misconception on the internet, in relation to the equity market when Amazon Inc’s stock split took effect on Monday, at open of trade. Equity market exchanges and analyses/portfolio management softwares were slow to price in Amazon’s forward stock split and what we saw was a supposed 96% fall in the company’s market cap (share price x number of shares issued) / share price. The effect; a hostility of shock waves, and fear on social media with investors or market participants that were unaware about the stock split. These splits are becoming more and more common, with a lot planned by US (Google, Tesla amongst others) companies this year.

Today at glance:

What are stock splits (forward and reverse), and their effect?

On the money - Africa’s start-up funding ecosystem is growing faster than Europe and the USA.

What are stock splits (forward and reverse), and their effect?

Forward stock splits happen when a company increases the number of its outstanding/issued shares by a certain multiple. While the market cap (price per share × number of shares issued) remains the same, this has the effect of dividing up the share price of each share prior to the split by the multiple used to increase the number of issued shares.

If it does not make sense already, think of it this way;

You have a whole round cake, and cut it up into 4 pieces to sell at R10 each, which everyone accepts to be the fair market value they would pay to have one piece.The market cap of the whole cake is R40. You could cut the cake up further, to 8 pieces, by cutting each of the 4 pieces in half, once, (an effective multiple of 2), and sell each of the, now, 8 pieces for R5.

The value (market cap) of the whole cake remains the same at R40, while each of the 8 pieces is now R5, and two pieces are the same value as each of the previous 4 pieces at R10 each.

The 20:1 split for Amazon means, every holder of 1 share, received 20 shares FOR the 1 they held, and so did the share price which was, before the split, $2450 divided by 20, down to $122. 5 (source :CNN) after the split.Forward stock splits have generally had a positive effect on the share price of a stock splitting company, due to increased demand from :

Better liquidity - in simple terms, smaller items are easier to move around than bigger items, hence better and widely traded

Attractive to more retail investors - compared to owning 1/20th of an Amazon share at $2450, 1 full share at $122. 5 has a more positive psychological effect of feeling full ownership, and backing your investment thesis.

Reverse stock splits have the opposite mechanism and effect. These stock splits happen when a company reduces the number of its outstanding/issued shares by a certain divisor.

While the market cap (price per share × # shares issued) remains the same, this has the effect of multiplying up the share price of each share prior the split by the divisor used to decrease the number of issued shares.

It becomes practically impossible to piece 4 pieces of cake together, but ,hypothetically, the cake example is still applicable with a reverse stock split. 4 pieces of a whole round cake worth R10 each (with a market cap of R40) become 2 pieces (effective divisor of 2), worth R20 each.

The track record of companies that reverse split, shows a pattern of poor financial health prior to the split, and parabolically declining equity price, hence reverse stock splits have generally had a negative connotation, because they artificially ‘inflate’ a company’s share price without correlation to better financial health. So, why would a company artificially inflate their share price?

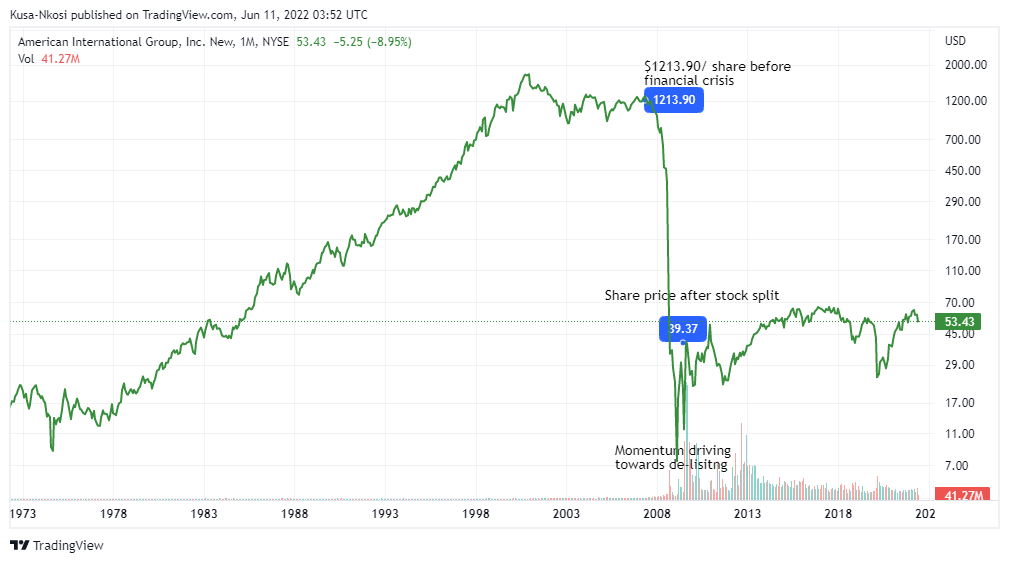

All stock exchanges have a minimum listing price for a share, meaning that if a certain company’s share price drops to below that threshold, that company would get delisted from the stock exchange. For the New York Stock Exchange, that minimum is $1, and an example of a once troubled company was AIG, suffering huge losses after the 2008/9 financial crisis, the company’s share price dropped all the way from $1214 to $2 per share, edging around delisting, which prompted the board of directors to vote for a 1:20 reverse stock split , which inflated the share price up to around $40.

To make their share price seem more attractive, the company’s share price might not be trading towards or a round delisting range, but a bit too low in a way that induces skepticism about its financials.

Just like how Amazon’s share price did not drop by 96%, AIG’s share price did not gain 95%, you have to measure the share price relative to the outstanding shares, which have been either increased or decreased because of a split.

There are a lot of stock splits coming up this year. Check out the stock split calendar on Yahoo finance.

On the money - Africa’s start-up funding ecosystem is growing faster than Europe and the USA.

The Big Deal writes my favourate update on the African start-up funding ecosystem, and on 31 May, published a report on how Africa is the fastest growing start-up funding ecosystem, at 150% year on year, with Nigeria leading the big 4 in funding.

Enjoy the full report below:

Thanks for reading curiosity, if you found this insightful, feel free to share so more people are exposed to Curiosity.

Talk to you soon! Stay Curious

-Kusa Nkosi

Every Thursday evening I string a few words and data sets together to put up my favourite love letter. Cuddle up with all my other friends to read my personal opinion on the intersection of: Global Fintech-Economics | Crypto and Blockchain Tech every friday evening.